Syensqo: what can be better than buying the rejects?

"Investments come in three varieties: undervalued at one price, fairly valued at another, and overvalued at a higher one. The goal is to buy the 1st, avoid the 2nd and sell the 3rd." - Seth Klarman

Rob Arnott of Research Affiliates has just launched an ETF that will invest in companies removed from major indices such as the S&P 500 and the Russell 1000. Since the exit from an index often forces massive sell-offs of the stock for many investors, the ETF will try to take advantage of exaggeratedly depressed prices. ‘Everyone likes underdogs. Why not buy the rejects?’ said Arnott to the Financial Times. ‘Especially given the historical evidence that they beat the index by 5% a year for the next five years at least.’

While the idea we present today, Syensqo, is not necessarily one ‘rejected by the indices’, in many ways it has been equally despised by many investors, judging by the performance of the stock.

Introduction and investment thesis

Syensqo SA (SYENS) is a Belgium-based company specializing in chemistry and scientific innovation that spun off from Solvay (SOLB) in December 2023 at €98.93. Today, it trades at €80.4, nearly 20% lower. The 52-week range is €67.41 to €109.9 and the all-time high was €105.3. Although it has bounced back somewhat from its lows, it is still in the lower part of its 52-week range.

We wouldn’t have taken interest in it if not for the fact that, despite having superior margins and a cleaner balance sheet than most of its competitors, SYENS is trading at a significant discount to them. We believe this is a classic example of the "spin-off anomaly" that Joel Greenblatt highlighted in his book with the unfortunate title "You Can Be a Stock Market Genius" (which we’ve discussed in this Substack — see our Phinia and Dowlais posts).

We think SYENS is worth as much as 35%-50% more as the company is a strong leader in several fast-growing niches with high barriers to entry that should allow the company to maintain its current high-margin profile, which the market is not giving them much credit for.

There are a few risks which are discussed in more detail below, but we see limited downside, creating an investment opportunity with, in our opinion, an asymmetric risk-reward profile.

Business overview

SYENS is a Belgian chemical manufacturer that spun off from Solvay in December 2023. At that time, Solvay split into two listed entities: an entity that kept the Solvay name (focusing on commodity businesses like soda ash, silica, peroxides, etc.) and SYENS (who focuses on higher growth and higher margin polymers and performance composites).

Solvay’s management (and several key investors) knew that the sum of Solvay’s parts was worth significantly more than what the market indicated, which is why Solvay decided to separate the two businesses and unlock SYENS’ value. In many ways Solvay is the “value” play of the spin-off and SYENS is the “growth” story. SYENS kept several business units of Solvay that are global leaders and present the potential for substantial growth. The company estimates that 90% of its revenue is realized in markets where it holds one of the top three market positions with significant market share, control of key raw materials and a global footprint. More on these growth businesses later, but first a quick discussion of the spin-off.

As part of the transaction, Solvay listed its shares on the exchanges Euronext Brussels and Euronext Paris. Solvay retains a stake of approximately 30% in SYENS. As a standalone company, SYENS will be able focus on its customers, capitalizing on their key markets and products.

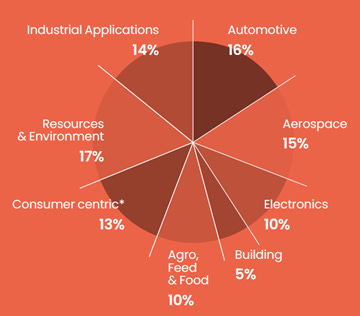

SYENS manufactures specialty polymers, composite materials and specialty formulations used in automotive and aerospace markets (28% of 2022 sales), resources and environment markets (15% of 2022 sales), industrial and chemical applications (15% of 2022 sales), consumer goods and personal care products (14% of 2022 sales), agricultural and food markets (13% of 2022 sales), electronics (8% of 2022 sales) and other end-markets. In 2023, the sales breakdown by market was very similar:

The company has identified four growth platforms: battery materials, materials for the green hydrogen ecosystem, renewable materials and biotech and thermoplastic composites. Amond the latter, the company’s lightweight composite materials stand out. SYENs is one of the few companies that can provide advanced lightweight composites that are critical for the aerospace industry, as they allow commercial and defense aerospace companies improve the aerodynamics of the aircraft, reduce CO2 emissions and lower total costs.

In terms of reporting, SYENS is organized into three operating segments:

Materials (Composite Materials and Specialty Polymers):

The Materials segment offers a unique portfolio of high-performance polymers and composite technologies used primarily in sustainable mobility applications. Its solutions enable weight reduction and enhance performance while improving CO2 and energy efficiency. Major markets served include next-generation mobility in automotive and aerospace, but also healthcare and electronics. This segment has generated EBITDA margins above 30% consistently since 2017.

Consumer & Resources:

Consumer & Resources offers unique formulation and application expertise through customized specialty formulations for surface chemistry and liquid behavior, maximizing yield and efficiency of the processes they are used in while minimizing the eco-impact. This segment also offers solutions focused on specific areas such as resources (improving the extraction yield of metals, minerals and oil), industrial applications (such as coatings), and consumer goods and healthcare (including vanillin and guar for home and personal care). This segment seems to be less differentiated, although the company argues that half of its sales are protected by patents or long-term contracts. The segment generates a lower EBITDA margin of around 17%.

Corporate & Business Services (such as R&D, cogeneration units dedicated to the SYENS activities and new business development):

The R&D platform (15% of employees) is key to the thesis as the company expects these investments to accelerate the growth profile of its products. SYENS plans to increase its R&D spending from the current 4% of sales (an annual R&D expenditure of over €300 million) to 5% by 2028. This is nearly double that of some of its competitors, such as Hexcel. The growth SYENS has achieved in the lightweight thermoplastic composites segment used in the aerospace and automotive industries (with the highest margins in the entire company) is a testament to the company’s R&D capabilities; in fact, R&D spending on this type of material has grown 300% in the last four years. This innovation effort, in addition to being the reason the company’s statement that more than 50% of its sales are protected by patents and long-term contracts, should support further product differentiation and generate new growth. Specifically, SYENS has identified "blockbuster" projects expected to generate more than €2 billion in sales after 2028. These include sulfides for solid-state batteries, advanced materials for hydrogen storage, lithium-ion salts and solvents for high-energy batteries, and other chemicals for hydrogen production and conversion.

Financial analysis and valuation

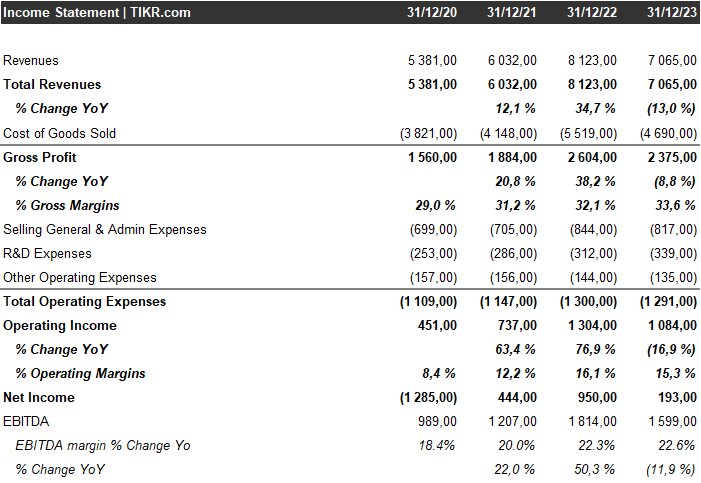

SYENS has been able to generate group EBITDA margins of about 20% consistently since 2017, and even higher in the last couple of years. In addition, the company has a strong balance sheet with approximately 1.3x Net Debt to EBITDA and ample liquidity available.

In Q2 2024, SYENS closed a senior bond issuance for USD 1.2 billion, split in two tranches, namely $600 million with a 5-year maturity and $600 million with a 10-year maturity. The ratings for the bonds are BBB+ and Baa1 from S&P and Moody's, respectively. The issue was met with strong interest with an order book exceeding $5 billion, according to management. As a result, SYENS has a balanced debt maturity profile:

Despite having superior margins and a cleaner balance sheet than most of its peers, SYENS trades at a remarkable discount to them.

The closest peer is probably Hexcel, a US-based manufacturer of advanced composite materials for the aerospace and defense industries. Hexcel has historically traded at a premium valuation, reflecting the company’s strong market position and high barriers to entry in their niche.

Victrex (VCT), a producer of high-performance polymers, such as PEEK, used in advanced applications in sectors such as aerospace, automotive and medical, has traded at an average multiple of 11-12x since 2010. Recently (2022-2024), as a result of slowing demand in key sectors for Victrex such as automotive, industrials and electronics and macroeconomic fears, the company's valuation has fallen (see EV/EBITDA multiple chart below). While it probably makes sense for Victrex to trade at a higher multiple than SYENS (somewhat higher margins and returns on equity), we believe the current discount (6.3x for SYENS vs. 7.7x for Victrex) is excessive. Moreover, once the pessimism about the sector has dissipated, we could see multiples on EBITDA closer to 10x again.

SYENS also trades at a discount to competitors such as Celanese (9.4x EV/EBITDA with similar margins, growth and returns on equity), for reasons we believe are not justified. Celanese has traded on average at a 9x-10x multiple in recent years.

An analysis of other comparables such as Croda, Ashland or Stepan would lead us to a similar conclusion.

As a standalone company, SYENS will be able to focus on extending its leadership positions and expanding its market share in solutions that help its customers improve the sustainability of their products. As a result, management expects organic sales growth of 5-7% per year between 2024 and 2028. For the full year 2024, SYENS expects EBITDA to be in the range of EUR 1.4 billion to EUR 1.55 billion. Therefore, we do not think it is crazy for SYENS to achieve EUR 1.5 billion EBITDA in 2025, which is what the consensus expects according to Bloomberg and looks very conservative to us.

Looking at industry multiples, a multiple of 9-10x seems reasonable, given the company's growth profile, margins, competitive position and balance sheet. Over the past four years, comparables Hexcel, Victrex, Celanese, EMS Chemie, Clariant, Croda, Ashland and Stepan have traded at an average multiple of 13-14x. In our opinion such a multiple would be too generous, given that it includes the year 2021 (peak of the “Everything Bubble”) and also the multiples of companies such as Hexcel or EMS Chemie, which have always had a “premium” valuation. If we remove these two companies from the sample and only look at 2022, 2023 and 2024 the average multiple has been approximately 11x EV/EBITDA.

Taking therefore a multiple of 10x, the valuation of SYENS would result in an enterprise value of EUR 15 billion and a market capitalization of EUR 13 billion. Compared to the current market capitalization of EUR 8.5 billion, this would represent more than 50% upside potential. Taking a more conservative multiple of 9x, the upside potential could be 35%. It is worth noting that we would not be surprised to see the company beat consensus estimates, although we do not need that to happen to support this investment idea.

J.P. Morgan has some useful tables in its initial coverage report (January 2024) with margins and multiples for the sector (apologies if size/quality is not great):

Risks

PFAS (Per- and polyfluoroalkyl substances) exposure: PFAS are a class of chemicals linked to environmental and health concerns, and many companies in industrial sectors have faced lawsuits, regulatory pressures, and significant cleanup costs related to their use. These were popular chemicals because of their strong resistance to heat, water and oil. SYENS has never produced these chemicals but has used them as raw materials. The company has eliminated the use of PFAS chemicals in the US from July 2021 and, while still uses them at its site in Italy, it has applied and developed technologies that can destroy fluorosurfactants (a specific type of PFAS often seen as more harmful) remaining in the environment at the site and aims to phase out their use by 2026. In February 2023, The Netherlands, Denmark, Germany, Sweden and Norway submitted an EU Restriction proposal of PFAS that the company believes would be too strict, as some of these chemicals are essential to the EU’s climate objectives. It would be shortsighted to ban them if the EU wants to succeed in its transition to a low-carbon society. SYENS believes in responsibly making, processing and using fluoropolymers and advocates for a science-based, targeted regulation of PFAS, as opposed to a wide ban.

- Another risk to consider is the potential for unexpected pricing pressure in SYENS's key product lines. The company has successfully implemented a value-pricing strategy in 2022 and 2023 and aims to continue focusing on effective pricing. However, if competitive dynamics intensify or customer demand weakens, SYENS may face challenges in maintaining these price levels. A shift in market conditions, such as increased competition or cost sensitivities among customers, could erode the company's pricing power, reducing margins and profitability. This would undermine the core strength of the current investment thesis, which relies heavily on SYENS's ability to sustain premium pricing. We believe this risk is limited as we believe the product portfolio is highly differentiated and its pricing power is defended by barriers to entry. Importantly, we believe this risk is key to the investment opportunity, as we believe there is room for significant re-rating as the market sees more evidence of the company’s ability to sustain pricing power and elevated margins.

Another risk is that the management team completes a large acquisition, in which case we would have to review the deal and re-underwrite the stock idea.

Conclusion:

In conclusion, SYENS represents a compelling investment opportunity, trading at a discount despite its strong market position, superior margins, and clean balance sheet. The company's leadership in high-growth niches protected by barriers to entry provides strong potential for long-term value creation. While risks related to PFAS regulation (which we think are manageable), pricing pressure, and potential acquisitions exist, these are mitigated by SYENS's differentiated product offerings and strategic focus. With the potential for 35%-50% upside, sales protected by patents or long-term contracts and a clean balance sheet, SYENS offers an attractive risk-reward profile, in our view.