The Perfect LBO

From dreaming of beating the benchmark to closing deals with billionaires at dawn

Cocoa Guy: (answering the phone, groggy in the early morning) Yes? Gordon Gekko: (walking on the beach at dawn) Money never sleeps, kid. I just made $800,000 in gold in Hong Kong. Send it to my account with you. You're doing well... but you need to keep doing well.

For those more initiated, a Leverage Buy Out (LBO) is simply going to the bank or the debt market (in all its variations), borrowing money, and buying a company by putting it up as collateral. Then, repaying the debt with the business's operational cash flows until it is yours, not the bank's.

In essence, this is an LBO, and among other things, it allows magnifying returns and even acquiring companies without putting in any money. For example, Eduardo Santos Ruiz entered Barón de Ley practically empty-handed and ended up taking over the entire company:

https://blogs.elconfidencial.com/mercados/rumbo-inversor/2020-07-23/baron-ley-control-cotizadas-ley-opas_2692484/

Within the 60 to 80 companies we have been following for years, we have seen that one of them currently has the ideal conditions to be the subject of an LBO.

We will explain everything well later.

But first, the company:

C&C, a brewery based in Ireland with a strong presence in the UK. After successive errors by the management team and recurring changes in top management, the stock plummeted a few days ago to reach 2009 lows.

C&C has a shareholder return of ~9%, which within a stable sector like consumer goods, presents an attractive option for a long-term portfolio. With the risks we already know and are seeing: changes in alcohol consumption habits and more regulatory hurdles similar to those seen in the tobacco sector.

In other words, it is a cheap company, where to contribute it would be enough to make a good conventional risk-return thesis. But... from our point of view, we believe there is another more interesting angle.

Due to the characteristics of the sector and the specific company, it may make sense and would not be unusual for it to be in a dealmaker's folder or on a fund's table.

And if not, as the subtitle says, for one day, we want to do the work of an investment banker. Explaining why we believe it is the perfect LBO. Who knows, it might catch the eye of some debt alchemist... those who wear silk ties.

C&C: Brief Description

C&C is a vertically integrated company that produces beer and cider and is a leader in the distribution of alcoholic beverages in the United Kingdom and Ireland.

C&C can be divided into two business lines:

C&C Brands

Among other iconic brands, it owns: Bulmers, the leading cider brand in Ireland; Tennent’s, the leading Scottish beer; and the international premium cider brand Magners. Additionally, it includes other brands such as premium and craft beers like Heverlee, Menabrea, Five Lamps, and Orchard Pig.

If we take the latest semi-annual accounts as a reference, this business line accounts for ~20% of C&C's total sales but contributes ~60% to operating profit. It is therefore the most profitable part of the group.

C&C Distribution

This division is the result of the 2018 acquisition of Matthew Clark and Bibendum (MCB), the leading beverage distribution company in the UK and Ireland for the hospitality and PUB sectors.

https://www.morningadvertiser.co.uk/Article/2018/04/04/C-C-Group-buys-Matthew-Clark-and-Bibendum/

Unlike C&C Brands, this is a high-volume, low-margin business. This acquisition was made in the context of the near-bankruptcy of the owner of Matthew Clark and Bibendum, which led C&C to make a somewhat transformational purchase at an opportune moment.

The logic behind this acquisition, which somewhat distorts the company's pre-deal numbers, is to control the channel and act as a booster for its own brands.

Source: own elaboration

A clarification is necessary. C&C closes the fiscal year in February, meaning the year in the columns is actually n-1. This is important to understand the fluctuations that can be seen, for example in 2021, where the impact of the first year of COVID-19 and lockdowns is reflected. Decreases of -64% in 2021 and almost recovery of sales in 2022, when lockdowns began to lift.

The current situation can be inferred by looking at this chart. The company is at 2009 lows, with a drop of approximately -65% from pre-Covid highs and about -50% from the average pre-Covid stock price.

To explain what is happening, we can refer to Toni Nadal, when he was coaching Félix Auger-Aliassime, and the latter was trying to give complex reasons for why he was failing so much in training lately.

Toni's reply: "No, you fail because you're not good." "And the balls don't go over the net." "And from here, we will try to improve."

In this case, we can simplify it to: the company has not returned to the €100 million operating profit it was making before Covid, and although sales have recovered, the margins have not.

Source: own elaboration

And from here: it would be necessary to understand if it is due to a rise in costs due to inflation, which could not be passed on to the customer. This results in a loss of pricing power and could be due to a lack of investment in marketing. A series of inefficiencies in distribution, which could be addressed with cost cutting and control. Or both at the same time.

But we are not going to focus on this, at least on this occasion.

C&C: LBO Framework

If any of us turn to Google Gemini and ask, "What are the characteristics for a company to be the subject of an LBO?"

We get this answer:

Stable and predictable cash flow.

Low prior indebtedness.

Potential for operational improvement.

Solid management team.

Stable and mature business.

Possibility of selling non-strategic assets.

Companies with low valuations.

Susceptible to being acquired.

C&C, at this moment, meets or has potential in all these levers.

Which makes it especially interesting to be a textbook LBO case. Let's go.

Stable and predictable cash flow goes hand in hand with a stable and mature business.

Companies that generate cash are needed to cover debt service and do not present certain cyclicality that could compromise the balance sheet.

What better sector than the counter-cyclical consumer sector?

C&C should not have strong fluctuations unless we return to a pandemic, war, etc. Hence the fluctuations in the last 5 years due to lockdowns.

Despite these possibilities, we believe the probability of this scenario is now lower for the next 10 years.

Regarding cash generation, the company publishes the following information:

Source: own elaboration

Conversion to cash from adjusted EBITDA, that is, without extraordinary expenses, of more than 80% over EBITDA, excluding 2021/2022, impacted by Covid-19.

In the event that the company returns to having €100 million in operating profit, equivalent to an EBITDA of ~€120 million, the company would have a minimum cash generation of €75 million to €80 million.

Source: FY2025 Trading Update

Taking into account the shareholder distribution for 2024, including dividends and buybacks, which could be comparable to FCF to Equity, it would be an FCFe Yield of ~9% based on the current market cap of €580 million.

Low prior indebtedness

According to the latest C&C earnings presentation, the net debt figure is €203 million including leasing, and €81 million excluding leasing. Relatively, it would have a DN/EBITDA ratio excluding leasing of 1.1x.

And according to the recent trade statement at year-end, the trend is confirmed:

Source: FY2025 Trading Update

Additionally, the terms of the debt they manage are extremely exceptional for the current times:

Source: Annual-Report-2024

C&C has most of its debt in euros and pounds at fixed rates between 1.7% and 2.74% with maturities from 2030-2032.

This means that a private equity firm could easily leverage the company up to a ratio of at least 3.5x DN/EBITDA, the condition of the current covenants, although we think a specialized fund could negotiate to improve this limit significantly.

Therefore, if we assume the consensus figure of €109 million EBITDA at year-end, this would give us the option for an additional debt increase of €300 million to €350 million.

Remember the idea of not putting in much money. This company capitalizes at €580 million, so a significant part of an acquisition (~50%) including premium could be financed with debt.

Potential for Operational Improvement

The potential for improvement seems quite evident. And it is something that would be among the current management's objectives: increasing the margin from 15% to 18% in the Branded line, and exceeding 3.5% in distribution.

Soruce: CC-Group-HY-Results-October

From our experience, cuts in consumer and brand businesses that lead to reduced marketing spending usually do not end well.

But if we look at the company's distribution part, a high-volume business that undoubtedly dragged down the group's margins after the acquisition, we can infer that there would be work to do. And that a private equity firm could execute well.

For now, this is what is planned by the current team:

Source: CC-Group-HY-Results-October

Solid management team

Since the voluntary retirement of Stephen Glancey in January 2020 after 8 years as CEO of C&C, there has been notable turnover in the position:

Sterward Gillilan held the position until November 2020, when David Forde took over, but he resigned in 2023, along with the announcement of a €25 million impact related to a series of errors while trying to implement a new ERP system in the distribution part.

Patrick McMahon, then CFO, assumed the role until he resigned a year later, in July 2024, due to a series of accounting errors that led the company to overestimate the group's operating profit.

Ralph Findlay took over responsibilities until recently, in January 2025, when Roger White was proposed as the new CEO.

To recap, this is the fifth CEO in less than 5 years. This seems to present, from the board's perspective, an opportunity to design a proper incentive strategy or to find a team capable of executing an aggressive cost-cutting strategy.

Both levers are within the ABC of a private equity capital fund.

Possibility of Selling Non-Strategic Assets

C&C has significant optionality among its assets. Successfully executing an LBO and repaying part of the debt makes the possibility of an exit quite feasible.

Additionally, there are multiple value creation options.

Selling the company in parts: on one hand, the distribution business could be optimized, consolidated within the sector to gain scale, and eventually spun off through an IPO.

Also, we find the possibility of selling its branded business line to a brewery group without presence in the UK and Ireland interesting. For example, Mahou-San Miguel, without debt and with cash generation, might decide to grow by buying these brands. We assume this transaction would not be done at 6x-7x EV/EBITDA of the current valuation.

In a very similar approach, someone has already raised their hand. The activist fund Engine Capital sent a letter to the board in June 2024 proposing a sale of the company, considering it the best way to create value for shareholders at this moment.

You can find the letter at this link:

https://www.businesswire.com/news/home/20240624711444/en/Engine-Capital-Sends-Letter-to-CC-Groups-Board-of-Directors-Calling-for-a-Review-of-Strategic-Alternatives

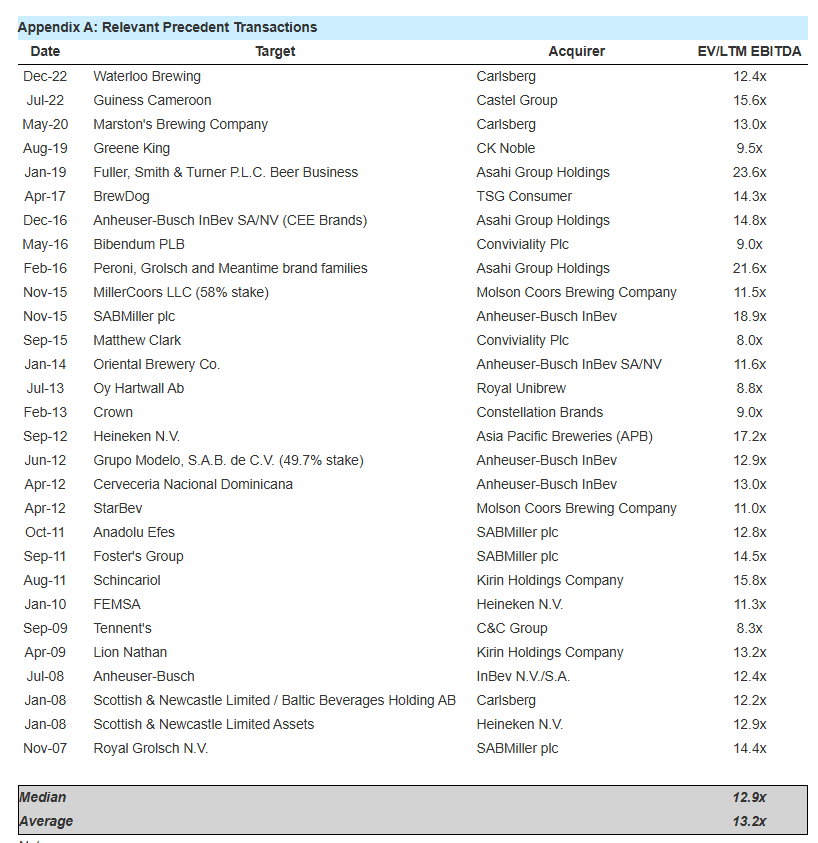

According to Engine Capital, at the July 2024 valuation (now even cheaper), ~7x EV/EBITDA, it would present a significant discount compared to the latest transactions within the sector. With their numbers, they estimate the group could be sold at a conservative range of between 239p and 263p, which means a return of 86% to 104%.

Although their valuation assumes a multiple of 10x-11x EV/EBITDA for 2025, they provide this table of comparables that supports applying a multiple of up to 13x EV/EBITDA.

Companies with Low Valuations

If you've read this far attentively, it is assumed that the valuation is attractive. But since we are operating within an LBO framework, we wanted to show the following rough numbers to see how much a fund could potentially pay in a takeover bid.

We have concluded that they could pay up to a 50% premium over Friday's price and still achieve a highly profitable operation.

Source: own elaboration

It includes an additional debt of €300 million on top of the existing €80 million, resulting in a ratio of ~3.5x DN/EBITDA. This implies an equity payment of ~€570 million at the start.

Increasing the debt by €300 million implies an increase in financial expenses, which, assuming an interest rate of 8%, should be €24 million in additional financial expenses. As we have mentioned, this company converts up to 80% of the current EBITDA, so after accounting for the impact on financials, €60 million of annual free cash flow seems quite coherent, and could lead to obtaining €300 million of accumulated FCF after 5 years. This amount would be used to repay the debt and increase the equity value.

To calculate the exit price in year 5, an exit multiple in line with what Engine Capital applies of 10x EV/EBITDA is assumed, after achieving an EBITDA of €120 million.

The IRR of this transaction would be 18%, and the cash return on equity 2.1x, very much in line with the usual profitability objectives of private equity funds.

Susceptible to Being Acquired

C&C does not have major shareholders controlling the company, and the percentage of shares held by the board is minimal.

Soruce: Annual-Report-2024

Among the top shareholders, there is an activist fund as already mentioned, and we even find the Magallanes Value Investors fund with 5%. However, none of them represent a group that could threaten a fund from obtaining a majority to carry out the transaction. And frankly, a 50% premium is quite tempting for a stock that has been in decline for years, making it difficult for a majority to reject.

Conclusion

A cheap company that generates cash, with little debt, and within a relatively stable sector.

C&C has significant optionality but clearly there is a leadership problem. This might be resolved with the new CEO, but perhaps not.

In any case, you know what we think: a cheap company cannot remain entirely cheap. If things go well, we will continue to see buybacks, dividends, or who knows, a corporate operation.

We end this story as we started:

Cocoa Guy: Mr. Gekko, I'm with you 110 percent. I'll send you the information about C&C. Gordon Gekko: I analyze 100 deals a day and select 1. But thanks for the post.

The information contained in this website and associated podcast is not, and should not be construed as, investment advice, and does not purport to be, or express any opinion concerning the price at which the securities of any company may trade at any time.

Each investor should make their own decisions regarding the prospects of any security or financial instrument discussed herein based on their own review of publicly available information and should not rely on the information contained herein.

The information contained in this website has been prepared based upon publicly available information and independent research. The authors do not guarantee the accuracy or completeness of the information provided. All statements and expressions herein are solely the opinion of the authors and are subject to change without notice.

Any projections, market outlooks or estimates mentioned herein are forward-looking statements and are based on certain assumptions and should not be construed as indicative of actual events that will occur. Other events not taken into account may occur and may significantly affect the performance or returns of the securities discussed herein. Except as otherwise indicated, the information provided herein is based on matters as they exist at the date of preparation and not as at any future date, and the authors assume no obligation to correct, update or revise the information in this document or to provide any additional materials.

The opinions, thoughts and viewpoints expressed in this blog and associated podcast are solely those of its authors, and do not necessarily reflect the opinions, thoughts or viewpoints of any of their past, present or future employers, or any other organization, committee or other group or individuals with whom they may be associated.

The authors, the authors’ affiliates and clients of the authors’ affiliates may currently have long or short positions in the securities of some of the companies mentioned herein, or may take such positions in the future (and may therefore benefit from fluctuations in the trading price of the securities). To the extent that such persons have such positions, there is no guarantee that such persons will maintain such positions.

Neither the authors nor any of their affiliates accept any liability whatsoever for any direct or consequential loss arising, directly or indirectly, from any use of the information contained herein. Moreover, nothing presented herein shall constitute an offer to sell or the solicitation of an offer to buy any securities.