“En la vida hay que creer, nunca hay que dejar de creer”. Diego Pablo Simeone

Hace poco mas de un mes en la entrada, “The Chilena Hand”, hacíamos eco de como el consorcio que controla la compañía Believe SA, había notificado la intención de realizar una Opa de exclusión a un precio de 15.30€.

En la entrada expusimos de manera detallada, que Believe había salido a bolsa en 2021 a un precio de 19.50€, y a pesar de que la compañía había mas que cumplido los objetivos de la IPO, los gestores pretendían sacarla de cotizar a un precio significativamente por debajo al que la vendieron hace 4 años en la colocación de acciones de la salida a bolsa.

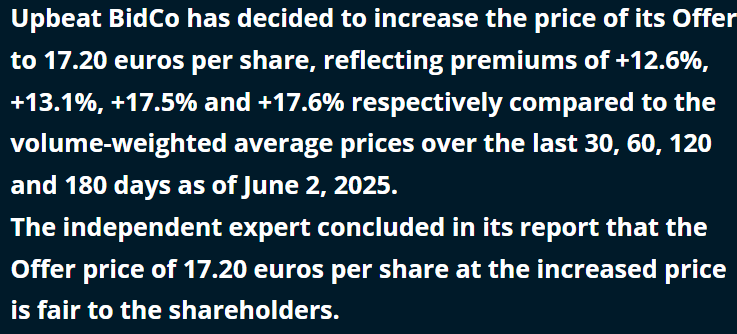

Finalmente, la magia ha entrado en escena, el consorcio ha subido la oferta a 17.20€, precio que coincide con la valoración del tercero independiente ( ya comentamos que este debía soportar un precio mayor), y donde posiblemente el regulador siente las bases para fijar un precio. Aunque nunca es descartable que este exija algo mas para autorizarla.

Así que estamos de enhorabuena otra vez, es la tercera idea de tres (NH, Societe Fonciere y Believe), en la que hemos acertado en esta tipología de situaciones especiales, Opas de exclusión con subida de precio final. Y no todos los días se gana un 11% en menos de 2 meses. You’re welcome.

En honor a esta idea de Believe SA, que tuvo sus idas y venidas, pero donde siempre confiamos en nuestro proceso y no dejamos de creer, compartimos este mensaje positivo del piloto Ayrton Senna, personaje siempre interesante de emular.

https://youtube.com/shorts/Qdu8ncQrbAc?feature=shared

Muchas gracias por su tiempo y apoyo.

Atentamente,

Cocoa Beans Podcast

Believe SA: Touché!

In life, you have to believe, you must never stop believing." - Diego Pablo Simeone

Just over a month ago, in our post "The Chilena Hand”, we reported on the consortium controlling Believe SA and its notified intention to launch a delisting tender offer at a price of €15.30.

In that article, we detailed how Believe went public in 2021 at an IPO price of €19.50. Despite the company having more than met its IPO objectives, the management intended to take it private at a price significantly below what they sold it for just four years prior in the initial public offering.

Finally, some magic has entered the scene! The consortium has raised its offer to €17.20. This price aligns with the valuation provided by the independent third party (we previously noted that they would likely support a higher price). It's possible the regulator is using this as a baseline for setting a final price, although it's always possible they'll demand a bit more.

We're happy to announce another win! This is the third time out of three (NH, Societe Fonciere, and Believe) that we've correctly predicted the outcome in these special situations involving delisting tender offers with a final price increase. It's not every day you earn an 11% return in under two months. You're welcome.

In honor of this Believe SA idea, which had its ups and downs but where we always trusted our process and didn't stop believing, we're sharing this positive message from the racing driver Ayrton Senna, a truly inspiring figure to emulate.

Thank you for your time and support.

Sincerely,

Cocoa Beans Podcast

DISCLAIMER

The information contained in this website and associated podcast is not, and should not be construed as, investment advice, and does not purport to be, or express any opinion concerning the price at which the securities of any company may trade at any time.

Each investor should make their own decisions regarding the prospects of any security or financial instrument discussed herein based on their own review of publicly available information and should not rely on the information contained herein.

The information contained in this website has been prepared based upon publicly available information and independent research. The authors do not guarantee the accuracy or completeness of the information provided. All statements and expressions herein are solely the opinion of the authors and are subject to change without notice.

Any projections, market outlooks or estimates mentioned herein are forward-looking statements and are based on certain assumptions and should not be construed as indicative of actual events that will occur. Other events not taken into account may occur and may significantly affect the performance or returns of the securities discussed herein. Except as otherwise indicated, the information provided herein is based on matters as they exist at the date of preparation and not as at any future date, and the authors assume no obligation to correct, update or revise the information in this document or to provide any additional materials.

The opinions, thoughts and viewpoints expressed in this blog and associated podcast are solely those of its authors, and do not necessarily reflect the opinions, thoughts or viewpoints of any of their past, present or future employers, or any other organization, committee or other group or individuals with whom they may be associated.

The authors, the authors’ affiliates and clients of the authors’ affiliates may currently have long or short positions in the securities of some of the companies mentioned herein, or may take such positions in the future (and may therefore benefit from fluctuations in the trading price of the securities). To the extent that such persons have such positions, there is no guarantee that such persons will maintain such positions.

Neither the authors nor any of their affiliates accept any liability whatsoever for any direct or consequential loss arising, directly or indirectly, from any use of the information contained herein. Moreover, nothing presented herein shall constitute an offer to sell or the solicitation of an offer to buy any securities.

Enhorabuena por el trabajo y por la generosidad al compartirlo!