New Takeover Bid for Believe SA: "The chilena hand"

"In life, you have to believe, you must never stop believing." - Diego Pablo Simeone

A little over a year ago, we shared the story of Believe SA, a niche record company specializing in the "indie" segment, which was almost the subject of a takeover war.

We leave here the links for further information:

Believe went public in July 2021 at a price of €19.50, and in February 2024 (less than 3 years later), in a context of less favorable interest rates for small companies, a consortium led by its founder and the EQT fund (hereinafter BidCo) announced their intention to launch a takeover bid at a price of €15, a 20% premium compared to the previous day's closing price.

Source: https://www.believe.com/newsroom/successful-initial-public-offering-believe-euronext-paris

The consortium, which already owned 72% of the shares, assured that after the takeover bid, it had no intention of delisting the company, although as we indicated here in the last two paragraphs of this entry: https://cocoabeanspodcast.substack.com/p/el-monitor-quincenal-de-cocoa-beans-b71 we did not give much credibility to this intention and assumed it could be part of a strategy.

Finally, in June 2024, they announced the results of the takeover bid with 95% shareholder acceptance, and in the months following the bid, BidCo continued buying in the market until it reached ~97%.

Source: https://www.believe.com/investors/capital-shareholding

Well, exactly one year after that takeover bid, during Holy Week and after the regulatory deadlines were met, BidCo announced its intention to launch a new takeover bid at a price of €15.30, and surprise... followed by a "squeeze out," meaning a forced exclusion of the remaining minority shareholders.

This means that if they went public in 2021 at a price of €19.50, in less than four years, they are going to try to delist the company, presumably at a price of ~€15, which is ~20% below the IPO price for the remaining minority investors.

Being a French company, and seeing what they have achieved, it is inevitable not to think of Zinedine Zidane and how he masterfully handled the ball.

Context: iconic gesture by Zidane known as "The Chilena Hand" after witnessing a spectacular play.

A first takeover bid below the IPO price

Below, you can check the financial information of Believe from the period 2020, up to the consensus estimates for 2025, which would be in line with Believe's guidance.

Source: own elaboration

In 2021: they grew above the company's target of 27% according to the latest review of 3Q21. (In this context, Believe now anticipates an annual organic growth of at least +27% in 2021 (compared to previous forecast of organic growth of at least +23%)

In 2022, despite not providing explicit guidance and being impacted by Russia and Ukraine, they had superior growth of 32%.

In 2023, the guidance was 18%, the growth was 16%, but as they themselves indicated in the press releases, without considering the impact of the currency, the growth was above guidance. (Adjusted organic growth of +19.5% in FY’23 and +21.8% in Q4’23. Organic growth penalized since Q2’23 by significant currency headwinds)

That is, at the time of the publication of the intention of the takeover bid in February 2024, and according to the trajectory up to the last closed year of 2023, the company had been meeting its targets year by year.

On the other hand, since the IPO, the company had been reiterating its mid-term objectives for the period 2021-2025.

Source: https://www.believe.com/sites/believe/files/2022-03/2022-03-17-FY-2021-Earnings-Presentation.pdf

According to the projected closing for 2025, it would be a CAGR growth of ~18%, slightly below the initially set targets (but without adjusting for currency), and with an improvement in profitability by exceeding the high end of the forecasted EBITDA margin range with 8%, according to Believe's guidance for 2025.

Note: Believe therefore expects an Adjusted EBITDA margin of c. 8.0%. Based on organic growth and margin targets, Adjusted EBITDA is set to further progress in FY’25 by at least +35%. Based on this profitability increase, Believe confirms a positive free cash flow in FY’25, above FY’24 level.

Result and conclusion of the previous takeover bid

The company, up to the moment of the takeover bid, had been meeting its targets year by year, which raises the question of whether it was fair to receive an offer below the IPO price.

One could counter-argue that the timing of the IPO was ideal and that the IPO price was actually overvalued.

These are the references from the time of the IPO, the announcement of the intention of the takeover bid, and the presentation of the official offer at the end of May 2024.

Source: own elaboration

We have included general market indices such as the Eurostoxx50 or the S&P500 and some more specific to the company like the French CAC40, the MSCI Europe Mid Cap due to Believe's market capitalization, or even the Nasdaq, which could be a proxy for growth tech companies.

As can be seen, the timing of the takeover bid does not stand out for presenting a negative or different context compared to the IPO in 2021.

All this being said, and despite the complaints of some investors (Sycomore, which holds about 1% of the capital of Believe, urges other minority shareholders not to tender their shares to the EQT-led bid in order to avoid a squeeze-out Charlot says he sees the stock’s fair value at about €26 per share, given the company’s operational performance), Believe managed to acquire 95% of the company in the takeover bid, with investors voluntarily accepting the price as fair.

Therefore, we can only congratulate those who designed the strategy for the total success of the launched takeover bid.

Current situation: Announcement of a takeover bid at €15.30 and subsequent delisting

On April 15 of this year, the following note was published by BidCo:

https://www.believe.com/sites/believe/files/2025-04/Press%20Release%20-%20UpBeat%20Bidco%20Buy-Out%20Offer%20on%20Believe%20-%2016.04.2025.pdf

The document announces the intention to launch a new takeover bid at €15.30 followed by a delisting of the stock.

If you have read carefully up to this point, you can infer that the price of the first takeover bid, at least for us, did not make sense, and now, in this second one, even less so.

The premium compared to the first takeover bid is 2%, despite the fact that at the time of launching that bid, the company had closed 2023 with an EBITDA of €50m, and now with the guidance provided for 2025, Believe is going to achieve ~€90m of EBITDA.

This means that they have increased the offer price by 2% for the 3% of the shares they do not own, despite the fact that, according to the company's own information, they are going to easily achieve 80% more EBITDA compared to the closed reference at the time of launching the previous bid, and after consolidating that they are already profitable and will continue with positive cash generation.

We have nothing more to add here...

What can we expect from this takeover bid?

Unfortunately, we do not have information about the shareholders who are holding onto their shares; they could be special situation funds or investors caught by the takeover bid at €19.50 and logically losing money under these conditions.

What we can confirm is that there has been a share exchange since this takeover bid was announced. Considering the illiquidity of the stock, Believe usually trades only 300 to 400 shares on average, but in the last two days, it is surprising that 75,142 and 33,571 shares have been traded. This means that if it is not the company buying them, someone has come to play the game.

The question one might ask is: Why announce the intention to launch a takeover bid for the remaining 3% and not directly request the forced exclusion?

This is what the regulator says about takeover bids and squeeze outs in France:

On one hand, we can see in the highlighted section that they must wait 12 months to launch a new takeover bid.

And additionally, it can be read here that after the takeover bid, the delisting of the shares can be requested, and here comes the important part... The AMF will review the offer, and an independent valuation is mandatory.

Therefore, we understand (disclaimer: we are not corporate lawyers or experts in French stock market regulation) that the strategy consists of a first phase of launching the takeover bid to the market, to see if, like in trawling, they can catch any investor. If they do not manage to get anyone to sell, they will have to request the forced exclusion and go to the regulator, who must decide if the offer for delisting is fair. Finally, the regulator can accept it or ask them to increase the price.

So, it seems clear that the more shares they manage to buy at €15.30 in a voluntary tender, the lower the risk of increasing their cost if the regulator disagrees and demands a higher valuation to authorize the exclusion.

The valuation of Believe

For the previous takeover bid, BidCo presented a draft offer prepared by BNP and Goldman Sachs:

https://www.believe.com/sites/believe/files/2024-04/Draft%20Offer%20Document%20-%2026.04.2024.pdf

Starting from page 33, you can find the details of the valuation, which, with the premium granted by BidCo, supported the takeover bid at €15.

And in the following document prepared by Believe, you can find the "FAIRNESS OPINION" conducted by the independent expert chosen by the board, in this case, Ledouble SAS, where from page 58, they provide their opinion on the valuation presented by BidCo and include their own valuation.

https://www.believe.com/sites/believe/files/2024-05/Believe%20-%20Response%20document%20incl.%20independent%20expert_30.05.2024_1.PDF

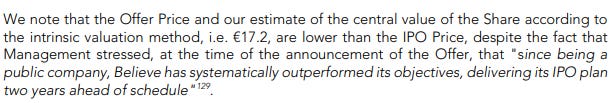

Spoiler alert: the valuation by the independent expert was significantly higher than the valuation obtained by the consortium making the offer.

Source: Believe - Response document incl. independent expert pag 45

The valuation presented by the consortium was primarily based on a DCF and annexes with multiples and comparable transactions, which the independent expert tried to review in the second attached document.

Firstly, regarding the discounted cash flows, the consortium's valuation was €10.1. It mainly highlights the use of a WACC of 12.8%, which, to simplify, would be equivalent to a P/E of 7.8x, a risk-free rate of 3.30% based on the French bond, when in our humble opinion, it is debatable whether it might make more sense to use the German reference, or an equity risk premium of 6.6%, compared to the 4.5% that we consider to be the commonly accepted average reference.

Source: draft offer document pag 43

In contrast, the independent third-party valuation was €17.2, 70% higher than the valuation presented by BidCo, primarily differing in the discount rate with a more moderate WACC of 11.5%.

Soruce: Believe - Response document incl. independent expert pag 49

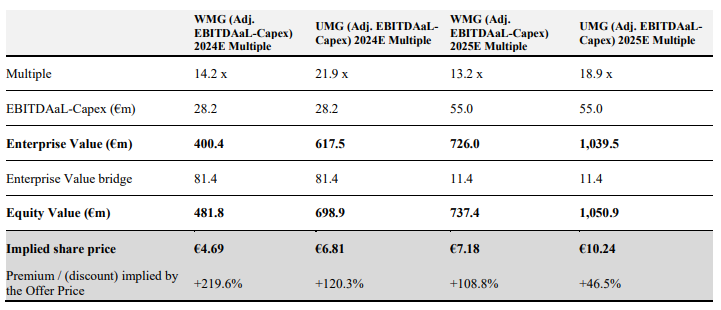

If we move to the valuation by multiples, BidCo's value range is from €4.69 to €10.24 with comparable peers in Universal and Warner.

Source: draft offer document pag 41

It should be noted that, although these companies belong to the same sector, they are much more mature businesses with logically lower growth prospects.

Source: Own elaboration with estimates from 2025 based on consensus

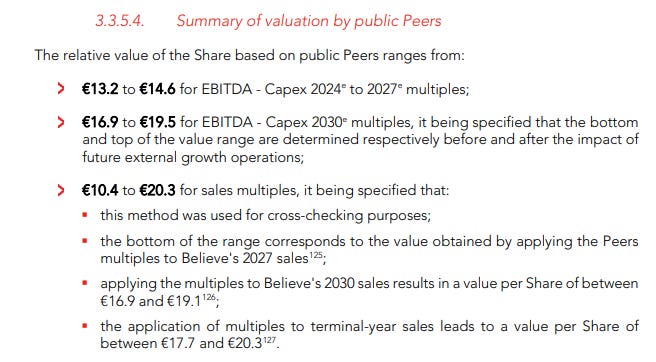

The independent third party, to address this, includes more comparables and adjusts for the growth effect.

Source: Believe - Response document incl. independent expert pag 43

Using the same EBITDA-Capex multiple, they obtain a range of €13.2 to €19.5, which is between 180% and 90% higher than the range offered by BidCo.

Source: Believe - Response document incl. independent expert pag 44

And finally, a table of comparable transaction multiples is provided, which in our opinion could be more appropriate for this situation, as in a forced exclusion of this nature, due to the lack of options for the minority shareholder, at least a compensation premium should be included.

Source: draft offer document pag 46

With this table, the valuation provided by BidCo is in the range of €6.2 - €10.3 and an average price of €8.57 if the average multiple is applied to the 2023 EBITDA.

We now recall that if we use the projected 2025 EBITDA of €90m, the valuation with that average multiple of 19.1x, which would include a premium, would be €18.20/share.

The independent third party adjusts this valuation by including other transactions and also incorporates 2024 EBITDA estimates, with a final range of between €8.8 and €14.1.

Source: Believe - Response document incl. independent expert pag 44

As can be read, according to their calculations, an average multiple of 21.6x should be applied for the transactions, which, if once again updated for Believe's projected 2025 EBITDA, the valuation of this independent third party would now be approximately €20,3.

We add that the only current reference from a different analyst than the OPA price comes from Stifel, who assumed an offer and valuation of €18 according to a report published on March 19, 2025, titled: Growth and Margins normalizing ahead of a new offer?

Recapping, with the data from the previous OPA, the consortium valued Believe at €10,1 versus the central valuation of €17,2 from the independent expert, and in the rest of the indicators of the latter, the ranges are also significantly higher.

The only valuation that could be acceptable in this case, as it includes a premium, would now give us a range of between €18.2 and €20,3.

Conclusion

The consortium that controls Believe, which includes its founder, seems to be trying to exclude the company at a price below its stock market placement. If it is confirmed that the price of €15.3 will also be used to request the exclusion, as mentioned, it would not reflect its fair valuation of at least €18 to €20.

Firstly, the 3% to which the OPA is directed will have the final say, which we assume (but cannot ensure) that if they did not accept €15 due to the low premium offered, they will not accept €15.3.

Secondly, the final decision will depend on the regulator. We must say that placing all hopes on the regulator makes it a risky bet, and possibly frustrating for the investors remaining from the initial IPO, who could consolidate a loss of -20%. Not so for the investors who have been entering with this news, as according to the current price of €15.4, it would present a certain risk of loss today at the expected OPA price of -0.6%.

The history of OPAs from controlling shareholders, at least in Spain, is uncertain and has not been free from controversial situations. An example of this can be found in protests such as those of Juan Gómez Bada (Investment Director at Avantage Capital):

https://blogs.elconfidencial.com/mercados/rumbo-inversor/2021-08-05/baron-de-ley-expropiacion-autorizada_3216592/

https://blogs.elconfidencial.com/mercados/rumbo-inversor/2025-04-03/catalana-occidente-otra-opa-en-la-que-los-minoritarios_4100262/

Or this thread on Twitter by Javier Ruiz (Investment Director at Horos Asset Management) about the OPA of Catalana Occidente, which, despite being at its peak and having been a very profitable opportunity for investors, indicates that the offer with the subsequent possible exclusion would not reflect 100% of the valuation of this company.

Source: @JRuizRuiz at Twitter

While in other situations this has gone reasonably well, such as the ideas we presented here, where the final valuation was relatively fair and double-digit returns could be obtained by betting on an exclusion OPA above expectations.

To conclude, we want to reiterate the following: the risk is high (at least of not achieving the planned valuation) and so far, the buying consortium has carried out a successful strategy with almost all shareholders voluntarily selling their shares.

In this case, being an OPA with a price higher than the previous OPA, relying on the regulator is likely to be a gamble.

We will continue to inform you of updates.

Sincerely,

Cocoa Beans Podcast

DISCLAIMER

The information contained in this website and associated podcast is not, and should not be construed as, investment advice, and does not purport to be, or express any opinion concerning the price at which the securities of any company may trade at any time.

Each investor should make their own decisions regarding the prospects of any security or financial instrument discussed herein based on their own review of publicly available information and should not rely on the information contained herein.

The information contained in this website has been prepared based upon publicly available information and independent research. The authors do not guarantee the accuracy or completeness of the information provided. All statements and expressions herein are solely the opinion of the authors and are subject to change without notice.

Any projections, market outlooks or estimates mentioned herein are forward-looking statements and are based on certain assumptions and should not be construed as indicative of actual events that will occur. Other events not taken into account may occur and may significantly affect the performance or returns of the securities discussed herein. Except as otherwise indicated, the information provided herein is based on matters as they exist at the date of preparation and not as at any future date, and the authors assume no obligation to correct, update or revise the information in this document or to provide any additional materials.

The opinions, thoughts and viewpoints expressed in this blog and associated podcast are solely those of its authors, and do not necessarily reflect the opinions, thoughts or viewpoints of any of their past, present or future employers, or any other organization, committee or other group or individuals with whom they may be associated.

The authors, the authors’ affiliates and clients of the authors’ affiliates may currently have long or short positions in the securities of some of the companies mentioned herein, or may take such positions in the future (and may therefore benefit from fluctuations in the trading price of the securities). To the extent that such persons have such positions, there is no guarantee that such persons will maintain such positions.

Neither the authors nor any of their affiliates accept any liability whatsoever for any direct or consequential loss arising, directly or indirectly, from any use of the information contained herein. Moreover, nothing presented herein shall constitute an offer to sell or the solicitation of an offer to buy any securities.