"It's like baking a cake, but with a lot more money and less flour."

Context: A dialogue between bankers to explain a complex financial transaction in the movie Barbarians at the Gate.

What we learned from the parables of the Bible is that water could be turned into wine... and perhaps this inspired the star financiers of the late 70s when, for the first time on Wall Street, they invented a way to turn debt into equity (LBO).

A month ago, the following idea of a "turnaround" came to us: an elegant way to refer to a company that, being like the Titanic, could manage to avoid the iceberg thanks to experienced captains who knew how to navigate through the ice.

We're talking about Zegona, a vehicle that participated in the consolidation of the telecommunications market (sale of Euskaltel to Másmóvil) and that a year ago returned to the Spanish market with the purchase of Vodafone Spain.

The operation, far from being simple, involves a financial structure with a lot of debt, preferred shares, and a little equity, which, if successful, thanks to the leverage effect, could lead to returns of more than 300%.

Although we recognize the complexity and our limitations to get to the bottom of the matter, due to Zegona's track record of doing this same thing in the past, and despite the fact that it has already risen 100%, we find it interesting to roll up our sleeves again.

Zegona Communications PLC: A Brief Introduction

Zegona is a telecommunications company founded in 2015 by Eamon O’Hare and Robert Samuelson, two former telecommunications executives with significant experience in senior roles at Virgin Media. They subsequently added key executives to the team, such as Menno Kremer, who joined in 2016 from Goldman Sachs with extensive experience in investment banking specializing in the TMT sector.

The management team, in addition to their experience, was aligned not only as shareholders but also through being highly incentivized by a performance-based share plan over the following 3 and 5 years.

Zegona could be defined as a telecoms-focused SPAC with a private equity approach: buy, improve, and sell.

In 2015, they raised £30 million with the aim of acquiring assets in the telecommunications sector. Despite being UK-based executives, they found a significant opportunity in Spain with the acquisition of Telecable, a cable operator in the north of the country. After various operational improvements, they managed to sell it for €700 million to Euskaltel, a listed Spanish telecommunications company. The deal included a cash component, which Zegona largely distributed to its shareholders, and another in Euskaltel shares, which led to Zegona acquiring a 15% stake in the latter. This stake gradually increased to over 20%, making Zegona the largest shareholder.

Source: diario económico Cinco días

In 2019, with Zegona's influence already felt in Euskaltel, Jose Miguel Garcia, a seasoned industry executive known for his success at Jazztel, joined as CEO. Garcia had built Jazztel from scratch into practically the fourth-largest Spanish operator. Specifically, from 2006 to 2015, he quadrupled revenues from €276 million to €1,176 million, creating a value of approximately €2,800 million after selling the company to Orange for €3,400 million, compared to its market capitalization of €600 million at the time of his arrival.

At Euskaltel, Jose Miguel Garcia led a new strategic plan to expand throughout Spain using the Virgin brand and through wholesale agreements with other telecom operators for the use of the fiber network nationwide.

In 2020, the industry began to see significant changes. Másmóvil was taken private through a tender offer by KKR and other partners, and subsequently, in 2021, Másmóvil launched a tender offer for Euskaltel for €3,500 million, prior to the final merger with Orange.

As a result of the cash distribution from the sale of Telecable and the dividend from the sale of its stake in Euskaltel, Zegona managed to return 87% to its shareholders.

Source: https://www.zegona.com/businesses-and-case-studies/case-study-euskaltel.aspx

Here we are: Zegona returns to Spain with the purchase of Vodafone

Exactly one year ago, the following note was published: https://www.zegona.com/~/media/Files/Z/Zegona/press-release/2023/23-10-31-zegona-acquistion-of-vodafone-spain.pdf, confirming what had been speculated in the press for several months. Zegona was returning to Spain to rescue the fallen soldier, Vodafone Spain. One of the leading telecoms in terms of market share, but which in recent years, and after a series of questionable strategic decisions, had been rapidly losing market share.

The purchase of Vodafone Spain was closed at €5.000 million and was initially structured as follows:

Bank debt of €3,800 million.

A revolving line of credit of €500 million.

Preferred shares worth €900 million issued to Vodafone.

A capital increase in Zegona of €300 million.

Additionally, there were two details that limited the downside risk:

The purchase was made at a very attractive multiple of 3.9x EV/EBITDAaL.

Jose Miguel Garcia (former CEO of Euskaltel and Jazztel) returned as CEO of the project.

As indicated in the heading of this idea, the operation is complex and requires two lines of action, which we have called miracles:

The miracle of converting debt into equity.

The miracle of selling Vodafone with a re-rating of the multiple.

Miracle Nº1: Converting Debt into Equity.

Within the terms of the Vodafone purchase, there is a component that is key to this story. According to the financing, 523.2 million preferred shares were issued for €900 million at a price of 150p, in addition to the 181.2 million ordinary shares for Zegona's shareholders in the capital increase. These preferred shares were issued to Vodafone as part of the financing in a "newco" company, EJLSHM Funding Ltd, with the characteristic that they can be redeemed at any time up to maturity in 6 years, and they do not have voting rights. In exchange, these preferred shares receive an annual return: 5% each year for the first three years, increasing to 10% in the fourth year, 12.5% in the fifth year, and 15% in the sixth year and thereafter.

Herein lies the miracle of the loaves and fishes: for practical purposes, Zegona's shareholding structure consists of 75% preferred shares held by Vodafone and 25% ordinary shareholders. If management can generate approximately €900 million and redeem the preferred shares, Zegona's ordinary shareholders will go from owning 25% to 100% of the company.

Source: Prospectus

The redemption of the preferred shares would increase the value of the ordinary equity, similar to how a homeowner's equity increases as they pay down their mortgage. Comparing it to Zegona, it would be as if the bank suddenly disappeared from our lives.

The big question is: given the current debt structure of up to €3.8 billion, how are they going to obtain €900 million to redeem the preferred shares?

The plan is to monetize the cable and fiber network. This is something we already discussed in our story about Liberty Global (part II), where we explained the benefits of creating value from a "Netco": https://cocoabeanspodcast.substack.com/p/liberty-global-parte-ii-no-puedes

In the Liberty Global post, we compiled several cases of fiber asset transactions closed at multiples of more than 20x EV/EBITDA. And in this case, if we look at the prospectus for the purchase of Vodafone, the operation revolves around selling the fiber network for between €2,000 million and €3,500 million but at a multiple of 15x EV/EBITDA.

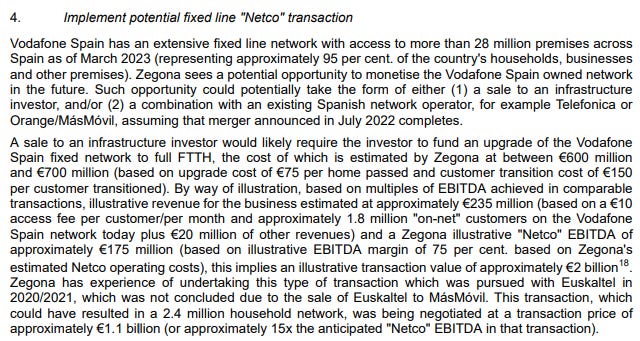

Source: Prospectus

The monetization method being explored is the creation of a mega-deal in the form of a joint venture with other telecoms willing to monetize their networks. And this is not just a plan or an aspiration. It is starting to become a reality: Zegona has already closed a deal with Telefónica in November and has published a note on a preliminary agreement with Másmóvil:

Fibreco JV with Telefónica: This agreement would cover 3.5 million FTTH homes and where they expect to reach 1.4 million customers, with shareholdings varying depending on customers in the areas of influence. Telefónica would retain 63% and Zegona 37%, although its share would fall to 10% after the entry of a financial partner. According to the details of the agreement, they estimate a "Runrate" EBITDA of €125 million for the next 3 years.

Netco JV with Másmóvil-Orange: This pre-agreement would cover 11.5 million homes and, like with Telefónica, Zegona would hold 10%, Másmóvil would hold 50%, and the rest would be given to a financial partner in exchange for capital.

How much could they obtain from a Netco operation together with Telefónica and Másmóvil?

According to the data provided by Zegona, based on the assets and customers contributed, they aspire to obtain 30% of the resulting Netco. And if we look at the prospectus, in the case of Másmóvil alone, they estimate a vehicle that would generate €800 million in EBITDA, leading to a valuation of Zegona's stake of €3,600 million.

Source: Prospectus

In a more conservative exercise, we arrive at the following valuation using a hybrid of the data provided by Zegona and what has been closed with Telefónica:

Netco JV Telefónica customers: 1.4 million confirmed customers in the official terms.

Netco JV Másmóvil customers: Estimated 5 million fixed-line customers based on data from Másmóvil and Vodafone.

Total revenue: If we take as a reference the official EBITDA provided in the JV with Telefónica (€125 million), and use the EBITDA margin (75%) provided by the low end of Zegona's prospectus, we can arrive at an annual revenue of €168 million, a more than reasonable figure if we perform the following check: €10 x 12 months x 1.4 million customers. Therefore, we can estimate total revenues of €768 million (€10 x 12 x 6.4 million customers) from the two joint ventures combined.

EBITDA: €576 million with a margin of 75% based on Zegona's low end range.

Multiple of 15x EV/EBITDA (all fiber transactions that we are aware of in Spain and outside of Spain have been done at >20x).

Valuation of the possible stake (30%): €2,600 million

Source: own elaboration

Initially, according to the attached notes, Zegona would retain a 10% stake, which would represent a cash-in of approximately €1,728 million upon the entry of the financial partner.

Conclusion: it is quite feasible that an operation will occur that leads to the option of canceling the preferred shares, and therefore multiplying the ownership of the current ordinary shares several times.

In our opinion, if at any point in the coming months, something firm is announced with the entry of a financial partner that confirms the monetization... the share price should start to soar like a rocket.

Miracle Nº2: Selling Vodafone Spain with a multiple re-rating (but without the network).

The purchase of Vodafone was made at a multiple of 3.9x EV/EBITDAal (Zegona metric), which if we adjust it by the "IFRS standard" would be ~5x EV/EBITDA compared to the purchase of Euskaltel at 10.1x EV/EBITDA or the merger between Orange and Másmóvil at multiples of 7.2x and 8.7x respectively. And previously, we also have in Spain: the purchase of Telecable at a multiple of 10.8x EV/EBITDA or even the purchase of Másmovil in 2020 for 10x EV/EBITDA.

The multiple of the operation to be a transaction is tremendously cheap and greatly limits the risk of the operation. Especially after having explained the optionality with the network.

In the second part of this story would come the true "MBA case study": waiting for a new wave of consolidation in Spain, the team would now have the role of improving and selling. Assuming that, without the fixed network and the towers (which were sold), Vodafone is now more similar to an MVNO (Mobile Virtual Network Operator), such as DIGI.

When we said that we were not going to be able to get to the bottom of the matter, we were referring to this part of the turnaround, which based on our experience, the cases in the sector that we have known have been difficult to restructure.

However, as we have mentioned Zegona's precedent in Spain, it was a success with Euskaltel. The verticals in which they worked in that case were the following:

Change of Management.

Cost cutting.

Growth plan through national expansion with the Virgin brand.

The framework of action for Vodafone Spain is being very similar. We go into detail with what is planned and carried out so far:

Change of Management

Little to say, Zegona has replaced the previous management of Vodafone Spain and the artificer of success of Euskaltel and Jazztel, is already piloting the ship: José Miguel García is the CEO of the project.

Cost cutting

The other pillar of Zegona is to turn Vodafone into a more profitable operator. Zegona recognizes that the cost structure is high and specifically points to the workforce with 4,000 employees compared to the 2,400 employees of Másmóvil. They also see room for improvement in technology spending optimizations and discretionary Capex, which they estimate at €1,000 million and €102 million respectively. Of which, through a reduction in bureaucracy, and incentives for managers and employees, they estimate that it can be reduced considerably.

Specifically, they estimate that the Operating cash flow margin was 11% and the EBITDAal margin of the business was 33%, significantly lower than the ratios of Euskaltel at 27% and 50% respectively or those of Másmóvil at 31% and 41% respectively.

They estimate that these margins could be achieved through a cost reduction that they quantify at €320 million per year.

To this end, they have established up to 8 areas of improvement, in which compared to the efficiency they achieved in reaching Euskaltel, they could obtain said saving.

You can see them in detail on pages 59-60 of the following document:https://www.zegona.com/~/media/Files/Z/Zegona/press-release/zegona-communications-plc-prospectus.pdfTo facilitate the work in the following table we have quantified how much would be the maximum saving in millions of € of achieving 100% of the cuts with the ratios of Euskaltel that Zegona explains:

Source: own elaboration

As generalists, we don't know much about almost anything, but we do know that if we can achieve €320 million in savings and capitalize it at a reasonable multiple, most of the thesis for re-rating would be done.

Work is already underway: regarding the staff reduction plan, it is possible that it will be more aggressive than the one proposed in the aforementioned table. Zegona initially launched a redundancy program for 1,200 workers, approximately one-third of the workforce, and in the latest updates, figures of an agreement for 900 people are being handled.

Source: Vodafone annual financial statement

With a conservative estimate of €60,000 gross average salary, this would imply, excluding layoffs and other social security expenses, an annual saving of only this part of approximately €70 million, practically double what we had quantified in the cost plan.

Growth plan: for the moment, stabilize the loss of customers

Industry The Spanish market is led by 3 operators with a combined market share of 78%: Telefónica, Orange-Másmóvil and Vodafone. There are also a number of virtual mobile operators that compete mainly on price, such as Digi, and some with a local or regional presence, such as Onivia, Lyntia or Adamo. Competition has led the leaders, in addition to focusing on premium customers, to create a number of low-cost brands such as 02, Lowi, Simyo or Jazztel.

The following graph shows how the Másmóvil group is the main gainer of market share in fixed lines, and how year after year, Telefónica and Vodafone have been losing share, with the latter being the one that loses the most share.

Source: CMC Telecom report

If we pay attention to the CEO's latest interviews and publications of Zegona's plan, the first mission is to stabilize revenues. A total of €3,900 million in 2023, of which approximately €2,450 million (63%) are retail and approximately €1,300 million (33%) correspond to the business segment.

As you can see here: Vodafone Spain has been in mourning for almost a decade.

Source: own elaboration

The company has been experiencing a continuous decline in revenue since before Covid: -6% in 2019, -8% in 2020, -3% in 2021, -0.3% in 2022, and -7% in 2023. Although the business segment (33%) is withstanding the decline, most of the loss is due to the retail segment.

Following industry dynamics, the most effective lever to stabilize revenue is to stop the customer churn, and this is measured through the "Churn rate" or customer cancellation rate: If we look at the data from the CNMC telecommunications report, Vodafone has by far the highest customer churn rate in the sector.

Lowi: More for less

Lowi is Vodafone Spain's low-cost brand, created in 2014, and is one of the central pillars to tackle customer churn. Similar to the strategy followed by Euskaltel with its national growth plan under the Virgin brand. With the published figures for 2023, Lowi had a total of 1.1 million customers, with an increase of 800k since 2021, and a market share of approximately 5%.

Despite Lowi's growth, since 2023 it has experienced some slowdown due to strong competition, mainly from the company Digi. In the first quarter of 2024 alone, it managed to be practically the only operator to grow in Spain, and achieved 355,700 portings, of which 60% correspond to former Vodafone customers.

Zegona has already addressed this problem with a value-for-money strategy: leveraging Vodafone's capabilities, better service, and quality of services, to provide a service with fiber, 5G, and Amazon Prime television at an attractive price. This is what Frank Lucas from American Gangster called "Blue Magic".

Source: Lowi corporate page

It is no coincidence that Zegona has hired Ángel Álvarez, until recently the chief commercial officer of Digi.

In May of this year, a significant improvement in Fiber + Mobile rates has already been announced for all customers within Vodafone's fiber coverage, which they call Fiber Fit. They include up to 5 Fiber + Mobile rates with unlimited calls + 300mb Fiber with prices ranging from €20 to €28, depending on the amount of data.

Preliminary valuation

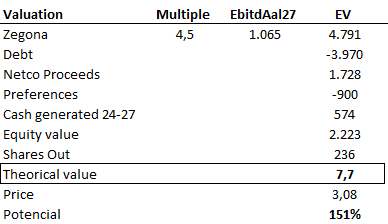

To carry out the valuation, we have considered the following hypotheses: The fiber assets of approximately €1,700 million are monetized and the preferred shares are canceled, going from €713 million per share to €181.2 million per share. Vodafone is sold with a multiple of 4.5x EV/EBITDA in 2027 after achieving the turnaround. Stability of revenues and improvement of margins in line with a telecommunications company with a lighter structure.

Source: own elaboration

Revenue stability has been assumed starting from 2025 with 1% growth and margin improvement from the gradual entry of the expected synergies (€320m): €50m in 2024, €150m in 2025, €100m in 2026, and €20m in 2027. EBITDA includes a €200m cost for the use of the fixed network after the sale of the Netco.

Source: own elaboration

*Updated theoretical valuation as of 02/01/2025 with an exchange rate of 0.83, adjusted for the 55 million new shares issued for Management

Conclusion

We are facing an operation with a lot of optionality, which, if Zegona's objectives are met, this thesis should be a multibagger. We acknowledge the complexity of the two situations explained, and as we indicated, we find it difficult to get to the bottom of some of the figures presented by Zegona, and in several of its estimates, but... What if they are right? We will continue with this story in a second part where we will try to delve deeper into the commercial plan as we can obtain more information about the strategy.

Hi Juan - this was such an enjoyable read. Can I just ask two quick clarification questions? Firstly, in the prospectus, they mention the fact that upgrading their network to FTTH would require 600mm in capex. How do you think that impacts the valuation of the Netco? I can think of a few ways to think about it (assume the investors just take it out of the valuation bc it's a cost of their investment? And secondly, I wanted to ask about your valuation. You added in the value of the FCF (574mm), but I think the FCF is Levered FCF (pre interest expense because you calculated it as EBITDAal - capex), so won't much of that FCF get consumed in debt service? Wasn't sure if I was missing something in your calcs? Happy to compare offline if easier too?

I was hoping to read more about this company. Thanks for the write-up!