Liberty Global: Parte III- No puedes ser el más grande, pero sí el más inteligente (English version at the end)

“Siempre hay un tesoro oculto en la nevera, solo tienes que buscarlo”. Homer Simpson.

Vamos a empezar por el final.

Tras el reparto de las acciones de Sunrise de noviembre de 2024, y que equivaldría a que nos hubiesen repartido un dividendo libre de impuestos del ~+50%, lejos de contraerse, el descuento holding en las acciones de Liberty se ha vuelto a ampliar. La buena noticia: el potencial ahora se mantiene en ~50%.

Recapitulemos como se ha ido desarrollando esta historia:

En la primera parte:

Contábamos con entusiasmo que habíamos encontrado algo muy bueno, y qué podríamos hacer un 50% de rentabilidad en poco tiempo pero teníamos pendiente de afinar los números:

Fuente: Cocoa Beans

En la segunda parte:

Volvimos con los números hechos. Establecimos un potencial no inferior al 65% desde nuestro precio de entrada de 17$ en nuestra valoración teórica de servilleta.

Fuente: Cocoa Beans

Adicionalmente, quisimos resaltar que el descuento holding se podría reducir a causa del gran catalizador que venía: el spin off de la teleco suiza Sunrise. Y como indicamos en nuestra cuenta de Twitter @Cocoabeans, así fue.

Tras unas semanas después del spin off, esta idea llegó a situarse en una rentabilidad del ~+40%.

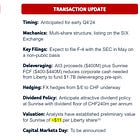

Fuente: cuenta de twitter @Cocoabeans

Donde estamos ahora:

El precio de Liberty ha corregido desde los máximos de 14$ (nuevo precio ex-Sunrise) después del spin off, a un precio actual de 11.50$. El descuento holding se ha vuelto a ampliar.

Lo mejor es que no ha pasado nada relevante.

Lo máximo que podemos encontrar es la rebaja de precio de algunos analistas porque “ya no habría catalizador”. Y aunque sí existe mucho valor, uno de nuestros lemas es: “el catalizador, es que no hay catalizador”. En este caso, es todo lo contrario… sí que hay catalizadores: tenemos una situación con catalizador (y más grande que todo Madrid), cotizando como si no hubiese catalizador. Lo que es doblemente interesante.

Liberty Global: Parte III

En la reciente presentación de resultados anuales de Liberty Global, se puede encontrar la habitual slide de valoración del holding facilitada por el management:

Fuente: https://www.libertyglobal.com/wp-content/uploads/2025/02/Liberty-Global-Q4-2024-Investor-Call-Presentation1.pdf

De los 11.50$ que cotiza la acción, 6$ (~50%) equivale cash. Ya solo con esto cualquier value investor dejaría lo que está haciendo y se pondría a mirar.

Continúan asumiendo que la cotización actual equivale, al cash de la compañía, las participaciones listadas y el resto de compañías no listadas de su cartera de crecimiento. Todo esto neto de los gastos de holding capitalizados.

Dicho también de otra forma: cotizando en 11.50$ el resto de la participaciones de telecomunicaciones: 50% de Virgin Media, Telenet, 50% VodafoneZiggo, Irlanda, todo con unos ingresos totales de $22bn y $8bn de Ebitda, valdría 0 según el mercado.

En palabras de Mike Fries (CEO), “hemos colocado Sunrise a un múltiplo de 8x EV/EBITDA, si asumimos que el resto de Telecos valen entre 5.5x a 6.5x EV/EBITDA, media de los comparables europeos, solo nuestras telecos valdrían 14$/acc”.

Recapitulando, all in all llegan a un valoración de +25$, es decir, Liberty Global todavía tendría un potencial de +100% (según Liberty).

Cocoabeans valuation: la motosierra

No dudamos de esta valoración y en ocasiones nos encontramos con sorpresas en las transacciones sobre todo en el mercado privado, pero ante la falta de información preferimos realizar el siguiente ajuste más conservador:

Fuente: elaboración propia

Llegamos a una nueva valoración ajustada de 18.3$ con los siguientes cambios respecto a nuestra valoración original (y que incluía Sunrise):

Posición actual de cash y SMA.

Ajuste a la baja de la valoración de VMO2 (recálculo del valor de la Netco) y VodafoneZiggo.

New ventures ajustado por la nueva valoración en libros. Al igual que la anterior valoración usamos un descuento del 30%.

Central & Corporate cost minorado por la salida de Sunrise y recalculado con un múltiplo de 10x.

Catalizadores: ¿ Alguien ha visto un cohete por aquí?

Liberty no ha sido la compañía favorita por los analistas. Y tiene su lógica. Es todo lo contrario al tipo de compañía “promercado”, que facilita un guidance claro, y que por supuesto acaba publicando dando justo los números necesarios para batirlo.

Una compañía holding con 4 telecos en diferentes países, optimizada de más financieramente, con un brazo inversor en 700 empresas, y sin una clara directriz al mercado del tipo de compañía buscan, no es exactamente fácil de modelar.

La prueba es que cuando nosotros ya estábamos “hot” en mayo de 2024, tras hacer los números en un cuaderno de cuadros, y después de leer que la compañía iba a seguir un plan inminente para aflorar valor, repartiendo tan solo una compañía del portfolio, y que suponía el 50% del precio de aquel entonces, las valoraciones de parte del consenso se mantuvieron asignándole nada o poco potencial.

Fuente: https://www.libertyglobal.com/wp-content/uploads/2025/02/Liberty-Global-Q4-2024-Investor-Call-Presentation1.pdf

En esta reciente slide describen la evolución de las acciones que están previstas para aflorar valor: el spin off estaría ejecutado, pero siguen avanzando en la creación de la Netco y en el plan de fusionar Telenet y VodafoneZiggo para crear un solo operador en Benelux.

La Netco está prevista que se cree y monetize en parte en 2025, y a pesar de lo que puede suponer….con respecto al momento del spin off en noviembre, el consenso de compra ha bajado, aumentando ratings ventas/neutrales, y todo a pesar del descenso en la cotización. Como dijo Yogi Berra “es como un deja vu de nuevo otra vez”.

Netco: ¿de cuanto estamos hablando?

En la anterior entrada intentamos hacer una aproximación al aire del valor de una Netco apenas sin información. A día de hoy, seguimos sin tener los detalles, pero empiezan a filtrarse posibles valoraciones en la prensa que podrían tener sentido.

https://www.thinkbroadband.com/news/10251-virgin-media-o2-looking-to-raise-1-billion-for-full-fibre-roll-out

Bloomberg destapaba la noticia de que Virgin Media estaría buscando levantar £1bn con una posible venta de hasta un 40% y con una valoración total de la Netco de más de £5bn, con varios fondos interesados como posibles compradores.

Liberty facilita en sus resultados un Adjusted Ebitda de £1bn para la Netco en la presentación de resultados. Que con respecto a una valoración de ~£5bn, no nos acaba de cuadrar. Suponemos que este Ebitda podría incluir otros servicios además de la banda, como TV o teléfono fijo.

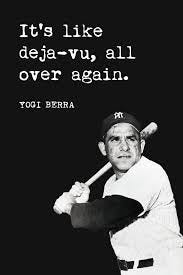

Para nosotros, y en función de las valoraciones filtradas, tiene más sentido estimar un Ebitda estable puro de red. Que posiblemente sea lo que haga un fondo de infraestructuras para hacer sus números. Por suerte tenemos la información reciente de Zegona.

Aquí se puede encontrar la información completa de aquella bonita historia donde hemos casi doblado en 5 meses:

Los gestores de Zegona, en el prospectus de la operación de compra de Vodafone España, facilitaban los economics de una Netco para la red de Vodafone en solitario, como es el caso de Virgin, y que por las características técnicas de la red, creemos que presentan ciertas similitudes.

Fuente: Prospectus

Vigin afirma que tiene 5.7 millones de clientes en banda con una cobertura en 16 millones de hogares. Con estos datos se puede llegar a unos revenues de £684m (10£ x 12 x 5.7), y un Ebitda de £513M (Margen 75% de referencia Zegona).

El resultado es una valoración de entre £6.600m y £7.700m a partir de un múltiplo de entre 13x (Base) a 15x(referencia Zegona).

Adicionalmente, y al igual que en Zegona, parte de la red de Virgin es HFC y habría que descontar el coste de actualizar a fibra (FTTH). Según los datos que facilitó el CEO de Liberty en una conferencia de Morgan Stanley en noviembre, 100£ por hogar es el coste de actualizar la fibra en hogares que ya tienen cable pasado. Liberty facilita que tendría una red de 16 millones de hogares de los que 4 millones serían fibra. Lo que indicaría que, se necesitaría unos £1.2bn de Capex para actualizar el resto de la red. Una vez descontado el Capex podría valorarse la Netco en un rango entre £5.400 y £6.500, lo que cuadraría con la información filtrada.

Nosotros pensamos que una Netco de estas características podría apalancarse hasta un nivel de 6x-6.5x DN/EBITDA, siendo por tanto el rango de £2.100m a £3.200m, el equity value posible en función del múltiplo final de valoración. Recordando que Virgin es una JV y el reparto es 50%-50% entre Liberty y Telefónica.

Conclusión: monetizar uno de los tantos activos que tiene Liberty con una valoración de equity en dólares para Liberty de entre; $1.365m y $2.080m, cuando capitalizas $4.100m, si que nos parece un GRAN catalizador.

Otros catalizadores: Más recompras, desinversiones non core y la fórmula E

Hay pocas compañías en el mundo de esta capitalización y tan seguidas por el mercado que hagan tantas recompras de acciones.

En los últimos 8 años han destinado $15bn a recomprar el 60% de las acciones. Y para 2025 tienen un target de recompra del 10% de la acciones restantes, lo que de poder ejecutarse a esta valoración con tanto descuento, generaría muchísimo valor para los accionistas.

Adicionalmente, y para financiar estas recompras prevén desinversiones de activos non core por un importe de $500m a $750m.

Y como movimiento interesante de crecimiento, destaca la inversión en la Fórmula E, que ha pasado de un stake minoritario a una participación mayoritaria del 65%.

No sabemos mucho de coches, pero sí que parece que la batalla futura en la industria pasa por el motor eléctrico y la Fórmula E podría ser el mejor sitio para dejar claro quien tiene el mejor coche. No sería raro ver inversiones fuertes por parte de Tesla, las marcas chinas, o las OEMs tradicionales en un intento de no perder su status. Posiblemente la compra de la Fórmula E, podría tener más sentido de lo que parece y no sabemos lo que podría valer en un futuro.

John Malone ya compró la Fórmula 1 a través de su otro grupo Liberty media y multiplicó por varias veces:

“When Liberty Media Chairman John Malone finalized the $4.4 billion acquisition of Formula One in 2017, he knew he was onto something”.

“Since Liberty Media acquired F1 in 2017, the sport’s value has doubled from $8 billion (including debts) to around $17 billion in 2023”.

¿Podría la Fórmula E desbancar a la Fórmula 1 en el futuro?

Como diría Rick Deckard sobre el futuro (Blade Runner).. “Yo he visto cosas que no creeríais”

Les deseamos una feliz semana,

Atentamente, Cocoa Beans podcast

Liberty Global: Part III - You Can't Be the Biggest, but You Can Be the Smartest

"There's always a hidden treasure in the fridge, you just have to look for it." - Homer Simpson.

Let's start at the end.

After the distribution of Sunrise shares in November 2024, which would be equivalent to receiving a tax-free dividend of ~+50%, far from contracting, the holding discount on Liberty shares has widened again. The good news: the potential now remains at ~50%.

Let's recap how this story has unfolded:

In the first part:

We were enthusiastically saying that we had found something very good, and that we could achieve a 50% return in a short time, but we still needed to fine-tune the numbers:

Source: Cocoa beans

In the second part:

We came back with the numbers done. We established a potential of no less than 65% from our entry price of $17 in our theoretical napkin valuation.

Source: own elaboration

Additionally, we wanted to highlight that the holding discount could be reduced due to the great catalyst that was coming: the spin-off of the Swiss telecom Sunrise. And as we indicated on our Twitter account @Cocoabeans, that’s exactly what happened.

A few weeks after the spin-off, this idea reached a return of approximately +40%.

Source: twitter account @Cocoabeans

Where we are now:

The price of Liberty has corrected from the highs of $14 (new ex-Sunrise price) after the spin-off, to a current price of $11.50. The holding discount has widened again.

The best part is that nothing relevant has happened.

The most we can find is the price reduction from some analysts because "there would no longer be a catalyst." And although there is a lot of value, one of our mottos is: "the catalyst is that there is no catalyst." In this case, it's quite the opposite... there are indeed catalysts: we have a situation with a catalyst (bigger than all of Madrid), trading as if there were no catalyst. Which is doubly interesting.

Liberty Global: Part III

In the recent annual results presentation of Liberty Global, you can find the usual holding valuation slide provided by the management:

Source: https://www.libertyglobal.com/wp-content/uploads/2025/02/Liberty-Global-Q4-2024-Investor-Call-Presentation1.pdf

Of the $11.50 at which the stock is trading, $6 (~50%) is equivalent to cash. Just with this, any value investor would stop what they are doing and take a look.

They continue to assume that the current price equals the company's cash, the listed holdings, and the rest of the unlisted companies in their growth portfolio. All this net of capitalized holding expenses.

In other words: trading at $11.50, the rest of the telecommunications holdings: 50% of Virgin Media, Telenet, 50% of VodafoneZiggo, Ireland, all with total revenues of $22bn and $8bn of EBITDA, would be worth 0 according to the market.

In the words of Mike Fries (CEO), “we placed Sunrise at a multiple of 8x EV/EBITDA, if we assume that the rest of the Telcos are worth between 5.5x to 6.5x EV/EBITDA, the average of European comparables, just our Telcos would be worth $14/share.”

Recapping, all in all, they reach a valuation of +$25, that is, Liberty Global would still have a potential of +100% (according to Liberty).

Cocoa beans valuation: the chainsaw

We do not doubt this valuation and sometimes we find surprises in transactions, especially in the private market, but due to the lack of information, we prefer to make the following more conservative adjustment:

Source: own elaboration

We arrived at a new adjusted valuation of $18.3 with the following changes compared to our original valuation (which included Sunrise):

Current cash and SMA position.

Downward adjustment of the valuation of VMO2 (recalculation of the value of Netco) and VodafoneZiggo.

New ventures adjusted by the new book valuation. As with the previous valuation, we used a 30% discount.

Central & Corporate cost reduced by the exit of Sunrise and recalculated with a multiple of 10x.

Catalysts: Has anyone seen a rocket around here?

Liberty has not been the analysts' favorite company. And it makes sense. It is the opposite of a "pro-market" company, which provides clear guidance and, of course, ends up publishing just the necessary numbers to beat it.

A holding company with 4 telcos in different countries, financially optimized, with an investment arm in 700 companies, and without a clear market directive of the type of company they are looking for, is not exactly easy to model.

The proof is that when we were already "hot" in May 2024, after doing the numbers in a graph paper notebook, and after reading that the company was going to follow an imminent plan to unlock value, distributing just one company from the portfolio, which accounted for 50% of the price at that time, the consensus valuations remained assigning it little or no potential.

Source: https://www.libertyglobal.com/wp-content/uploads/2025/02/Liberty-Global-Q4-2024-Investor-Call-Presentation1.pdf

In this recent slide, they describe the evolution of the actions planned to unlock value: the spin-off would be executed, but they continue to advance in the creation of Netco and the plan to merge Telenet and VodafoneZiggo to create a single operator in Benelux.

Netco is expected to be created and partially monetized in 2025, and despite what it may imply... since the spin-off in November, the buy consensus has decreased, increasing sell/neutral ratings, all despite the drop in the stock price. As Yogi Berra said, "it's like déjà vu all over again."

Netco: How much are we talking about?

In the previous entry, we tried to make an approximate valuation of Netco with barely any information. To this day, we still don't have the details, but possible valuations are starting to leak in the press that could make sense.

https://www.thinkbroadband.com/news/10251-virgin-media-o2-looking-to-raise-1-billion-for-full-fibre-roll-out

Bloomberg revealed the news that Virgin Media is looking to raise £1bn with a possible sale of up to 40% and a total valuation of Netco of more than £5bn, with several funds interested as potential buyers.

Liberty provides an Adjusted EBITDA of £1bn for Netco in the results presentation. Which, compared to a valuation of ~£5bn, doesn't quite add up for us. We assume this EBITDA could include other services besides broadband, such as TV or landline.

For us, and based on the leaked valuations, it makes more sense to estimate a stable pure network EBITDA. Which is possibly what an infrastructure fund would do to make their calculations. Fortunately, we have recent information from Zegona. Here you can find the complete information of that beautiful story where we have almost doubled in 5 months:

The managers of Zegona, in the prospectus for the acquisition of Vodafone Spain, provided the economics of a Netco for Vodafone's standalone network, similar to Virgin's case, and due to the technical characteristics of the network, we believe they present certain similarities.

Source: Prospectus

Virgin claims to have 5.7 million broadband customers with coverage in 16 million homes. With this data, revenues can reach £684m (£10 x 12 x 5.7), and an EBITDA of £513m (75% margin, reference Zegona).

The result is a valuation between £6,600m and £7,700m based on a multiple of 13x (Base) to 15x (reference Zegona).

Additionally, and similar to Zegona, part of Virgin's network is HFC and the cost of upgrading to fiber (FTTH) would need to be deducted. According to the data provided by Liberty's CEO at a Morgan Stanley conference in November, £100 per household is the cost of upgrading fiber in homes that already have cable. Liberty indicates that it has a network of 16 million homes, of which 4 million are fiber. This would mean that approximately £1.2bn of Capex is needed to upgrade the rest of the network. Once the Capex is deducted, Netco could be valued in a range between £5,400m and £6,500m, which aligns with the leaked information.

We believe that a Netco of these characteristics could leverage up to a level of 6x-6.5x DN/EBITDA, therefore the range of £2,100m to £3,200m would be the possible equity value depending on the final valuation multiple. Remembering that Virgin is a JV and the split is 50%-50% between Liberty and Telefónica.

Conclusion: monetizing one of the many assets Liberty has with an equity valuation in dollars for Liberty between $1,365m and $2,080m, when capitalizing $4,100m, seems like a GREAT catalyst to us.

Other catalysts: More buybacks, non-core divestments, and Formula E

There are few companies in the world of this capitalization and so closely followed by the market that make so many share buybacks.

In the last 8 years, they have allocated $15bn to repurchase 60% of the shares. And for 2025, they have a target to repurchase 10% of the remaining shares, which, if executed at this valuation with such a discount, would generate a lot of value for shareholders.

Additionally, to finance these buybacks, they plan non-core asset divestments amounting to $500m to $750m.

And as an interesting growth move, the investment in Formula E stands out, which has gone from a minority stake to a majority participation of 65%.

We don't know much about cars, but it does seem that the future battle in the industry is about the electric engine, and Formula E could be the best place to show who has the best car. It wouldn't be surprising to see strong investments from Tesla, Chinese brands, or traditional OEMs in an attempt not to lose their status. Possibly the purchase of Formula E could make more sense than it seems, and we don't know what it could be worth in the future.

John Malone already bought Formula 1 through his other group Liberty Media and multiplied it several times:

“When Liberty Media Chairman John Malone finalized the $4.4 billion acquisition of Formula One in 2017, he knew he was onto something”.

“Since Liberty Media acquired F1 in 2017, the sport’s value has doubled from $8 billion (including debts) to around $17 billion in 2023”.

Could Formula E overtake Formula 1 in the future?

As Rick Deckard would say about the future (Blade Runner)... "I've seen things you people wouldn't believe."

We wish you a happy week,

Sincerely, Cocoa Beans podcast

The information contained in this website and associated podcast is not, and should not be construed as, investment advice, and does not purport to be, or express any opinion concerning the price at which the securities of any company may trade at any time.

Each investor should make their own decisions regarding the prospects of any security or financial instrument discussed herein based on their own review of publicly available information and should not rely on the information contained herein.

The information contained in this website has been prepared based upon publicly available information and independent research. The authors do not guarantee the accuracy or completeness of the information provided. All statements and expressions herein are solely the opinion of the authors and are subject to change without notice.

Any projections, market outlooks or estimates mentioned herein are forward-looking statements and are based on certain assumptions and should not be construed as indicative of actual events that will occur. Other events not taken into account may occur and may significantly affect the performance or returns of the securities discussed herein. Except as otherwise indicated, the information provided herein is based on matters as they exist at the date of preparation and not as at any future date, and the authors assume no obligation to correct, update or revise the information in this document or to provide any additional materials.

The opinions, thoughts and viewpoints expressed in this blog and associated podcast are solely those of its authors, and do not necessarily reflect the opinions, thoughts or viewpoints of any of their past, present or future employers, or any other organization, committee or other group or individuals with whom they may be associated.

The authors, the authors’ affiliates and clients of the authors’ affiliates may currently have long or short positions in the securities of some of the companies mentioned herein, or may take such positions in the future (and may therefore benefit from fluctuations in the trading price of the securities). To the extent that such persons have such positions, there is no guarantee that such persons will maintain such positions.

Neither the authors nor any of their affiliates accept any liability whatsoever for any direct or consequential loss arising, directly or indirectly, from any use of the information contained herein. Moreover, nothing presented herein shall constitute an offer to sell or the solicitation of an offer to buy any securities.

Exquisito 🤌

Perfectamente, muchas gracias por la respuesta!